Google Ads saw major changes in 2025 that affected how ads appear on search results and how much advertisers pay per click. Two key developments stood out:

-

Multiple Ads per Domain on One SERP: A new update allows the same advertiser’s ads to appear in different positions on a single Search Engine Results Page (SERP). This change, rolled out in April 2025, altered long-standing “double serving” rules and could impact competition on the page.

-

Significant CPC Increases: Across Google Ads, the cost-per-click (CPC) surged in 2025 compared to 2024. Industry benchmark data shows double-digit percentage increases in average CPC, with some sectors experiencing dramatic jumps. This report explores data on these trends and dissects why CPCs are rising – from higher advertiser demand and auction changes to macroeconomic factors – and what it means for advertisers.

In this comprehensive report, we explain each change with data-driven insights and charts, and provide perspective for small business advertisers (including DIY marketers and those working with agencies) on how these changes affected their campaigns, performance, and budgeting. All insights are based on verifiable sources like official Google updates and respected industry analyses. Let’s dive in.

Multiple Ads from the Same Domain on One SERP (April 2025 Update)

In April 2025, Google made a pivotal update to its Google Ads Unfair Advantage Policy, effectively allowing an advertiser to have more than one ad showing on the same search results page – as long as those ads appear in different ad “blocks” (top vs. bottom of the page). Previously, Google’s policy prevented the same domain or company from “double serving” ads on one page to ensure fairness. Here’s what changed:

-

Policy Rollout: On April 14, 2025, Google updated its policy to permit the same advertiser (same company/domain and even the same ad/landing page) to show ads in multiple locations on a SERP, provided they are not in the same ad slot grouping. In practical terms, if an advertiser’s ad wins a spot among the top ads, Google also allows that advertiser to compete for the bottom-of-page ad slots on that query. This update was officially announced later in April after months of testing.

-

Rationale and Google’s Testing: Google’s decision was data-driven. According to Google Ads Liaison Ginny Marvin, internal tests “for several months” showed that allowing an advertiser’s ad to appear again at the bottom of the page increased the prevalence of highly relevant ads by about 10% and boosted bottom-of-page ad conversions by roughly 14%. In other words, users who scroll down saw another relevant ad (sometimes from the same brand) and were more likely to convert on those bottom ads, improving both user experience and advertiser outcomes. Google concluded that showing an additional ad from the same source (with different content tailored to the bottom slot) can be useful to searchers, rather than showing a potentially less relevant ad from a different advertiser.

-

How It Works: Google clarified that it runs separate ad auctions for each ad location on the page – the top ads section and the bottom ads section are independent. With the new policy, if an advertiser wins a spot in the top section, they can also be eligible for the bottom section’s auction. Importantly, Google still does not allow an advertiser to “stack” multiple ads in the same ad block. Within the top ads carousel (usually up to 3–4 ads) or within the bottom ads group, you won’t see two ads from the same company. The change simply means one advertiser could occupy, at most, one top slot and one bottom slot in a single SERP. Google insists this isn’t considered true “double serving” because the ads aren’t competing in the same auction or position. Notably, advertisers will never bid against themselves in any single auction – Google’s system ensures an advertiser’s two ads don’t drive up each other’s bids.

-

Impact on Ad Visibility: As a result of this update, a user might scroll through Google search results and see, for example, Brand X in the top sponsored results and Brand X again in the bottom ad section (with a different ad variation or messaging). Google has stated that the content shown in the bottom ad may differ from the top ad to better match the context “lower down the page”. For advertisers, this offers a second chance to capture the user’s attention if they didn’t click the first ad. Google’s testing suggests this can lift total conversions, especially from the bottom slots.

-

Effect on Competition: This change sparked debate about fairness and competition. Google’s stance is that the update improves auction fairness and user experience. By restricting one advertiser to one ad per section, it continues to prevent anyone from monopolizing all the top spots, while still allowing highly relevant ads to show again below. In theory, this could level the playing field in the top auction: big advertisers can’t fill every top slot with their own ads (which was already disallowed), potentially leaving room for other advertisers to appear alongside them. However, many in the PPC community have expressed concern: if large advertisers with deep pockets can now occupy both a top position and a bottom position, that is increased real estate for the biggest players on a given page. As one advertiser commented, “now the advertisers with the most to spend in each niche will get even more real estate and be able to show twice, potentially cutting out smaller competitors completely.” Another noted it could allow a “someone with deep pockets to dominate” the page if not carefully balanced.

-

Reporting and Metrics: Google confirmed that this change does not introduce new reporting metrics for advertisers. If your ad happens to show in both top and bottom positions for the same search, it will simply count as two impressions – one in “Top” and one in “Other” (bottom) – in your reports. There isn’t a flag that explicitly ties them together per search. Google recommends using the existing “Top vs. Other” segmentation in Google Ads reporting to analyze performance by top vs. bottom placements. In short, your total clicks, impressions, and conversions are counted normally, just broken out by placement if you choose to view it that way. No changes to Ad Rank or query matching were made aside from opening eligibility for bottom slots.

Bottom line: Starting mid-April 2025, Google Ads has allowed the same domain/advertiser to appear twice on one search page (once in the top ads and once at the bottom). Google’s testing found this increases relevant ad exposure and conversions, but marketers have been watching its effect on competition closely. Small and mid-sized advertisers are hopeful that enforcing “one ad per advertiser per section” could prevent big brands from occupying all top spots, potentially giving others a chance at visibility. On the other hand, the fact that big brands can now also take a bottom slot means total presence per page can actually increase for those with budget, which could further squeeze out smaller competitors. We’ll discuss more on small business implications shortly, but first, let’s look at the second major trend: a sharp rise in advertising costs.

Surge in Google Ads Cost-Per-Click (2025 vs 2024)

If you ran Google Ads during 2025, you likely noticed that costs were higher for the same clicks compared to the previous year. This was not just anecdotal. Data from thousands of campaigns confirmed a significant increase in average CPC across the platform. Below, we present comparative data on CPC trends from 2024 to 2025, including industry-level breakdowns, to quantify this shift.

-

Average CPC jump: The average cost per click in Google Ads (across all industries) climbed from about $4.66 in 2024 to $5.26 in 2025, an increase of roughly 12.9% year over year (source). In percentage terms, this represented a notable rise in advertising costs. By contrast, in the prior year, CPC increases were far more modest (around 2% on average for many industries), indicating that 2025 marked a clear acceleration in paid search inflation.

-

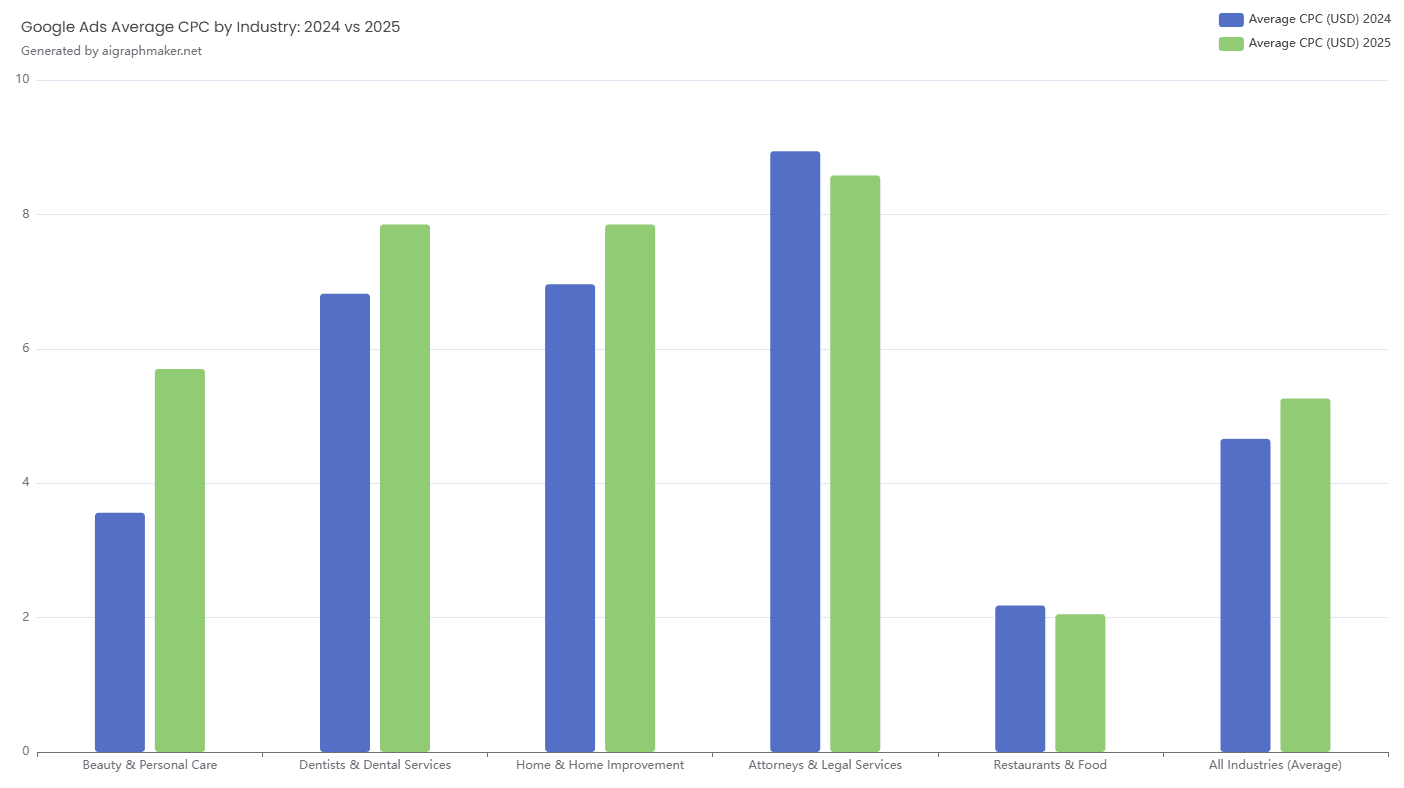

Widespread increase: According to a comprehensive benchmark report analysing more than 16,000 campaigns, 87% of industries saw higher CPCs in 2025 than in 2024. In other words, the cost surge was broad-based, affecting the vast majority of sectors from legal and healthcare to retail and services. This pattern is illustrated in Figure 1 and the table below, which highlight some of the more notable changes.

Figure 1: Average Google Ads CPC rose by approximately 12.9% year over year in 2025, reaching roughly $5.26 overall, according to industry benchmarks. More than 87% of industries experienced CPC increases, with some categories seeing particularly large jumps. The silver lining was that average conversion rates also improved (around 6.8% higher globally), which helped limit cost-per-lead growth to roughly 5%.

-

Industry-by-industry trends: CPC increases were especially steep in certain industries, while a small number of sectors saw stable or slightly lower costs. Below is a comparison of average CPC by industry in 2024 versus 2025 for select categories relevant to many small and medium-sized businesses, along with the year-over-year percentage change.

Industry Avg. CPC (2024) Avg. CPC (2025) YoY Change Beauty & Personal Care $3.56 $5.70 +60.1% Dentists & Dental Services $6.82 $7.85 +15.1% (approx.) Home & Home Improvement $6.96 $7.85 +12.8% (approx.) Attorneys & Legal Services $8.94 $8.58 –4.0% Restaurants & Food $2.18 $2.05 –6.0% All Industries (Average) $4.66 $5.26 +12.9% Table: Google Ads search average CPC by industry, 2024 vs 2025. Most sectors experienced higher costs during 2025, although a small number of traditionally high-CPC industries saw slight declines. Data source: LocaliQ / WordStream 2025 Benchmarks.

As shown above, some industries experienced especially sharp CPC growth. For example, Beauty and Personal Care advertisers paid roughly 60% more per click on average in 2025 than they did a year earlier. Education-related keywords also saw large increases (around 42%), while Shopping categories such as retail gifts and collectibles rose by approximately 34%. These year-over-year jumps point to significantly intensified competition or other structural pressures within those verticals.

By contrast, a few categories bucked the broader trend. Notably, Legal Services CPCs dipped by around 4%, though they still averaged a high $8.58 per click, placing them among the most expensive categories overall. Restaurants and Arts and Entertainment also recorded modest declines of roughly 5–7%. Despite these exceptions, the overall picture by the end of 2025 was clear: the cost to advertise on Google Search had increased by roughly 13% across the board, representing a substantial shift in a single year.

-

Historic context: To place 2025’s CPC inflation in perspective, Google’s own financial reports covering 2019 to 2024 suggested an average annual CPC increase of only around 2.3% historically. Even allowing for differences in methodology, a 12–13% rise in a single year was extraordinary. WordStream noted in its 2024 report that average CPC growth had already reached about 10%, up from roughly 2% in earlier years, indicating that the acceleration continued into 2025. By year end, many marketers were openly referring to “CPC inflation” as an ongoing condition rather than a temporary anomaly.

-

Ad spend versus traffic: Another lens on this trend came from comparing advertiser spend with traffic growth. Industry analysis showed that in Q1 2025, total Google Search ad spending rose by approximately 9% year over year, while click volumes increased by only about 4%. When spend grows faster than clicks, the gap is effectively absorbed as higher CPCs (roughly a 5% increase in that quarter). As 2025 progressed, this imbalance persisted or widened in many industries, contributing to the double-digit CPC increases observed by year end.

-

Why higher CPCs mattered: The rise in CPCs was not merely an abstract trend; it carried direct budget implications. With cost per click up by around 13%, advertisers saw higher cost per acquisition (CPA) or cost per lead unless conversion rates improved. During 2025, average conversion rates did increase, helping to offset some of the pressure. Benchmark data showed that the average conversion rate in search ads rose to 7.52% in 2025, up about 6.8% from 2024. As a result, the average cost per lead increased by only around 5%, from approximately $66.69 in 2024 to $70.11 in 2025. This suggested that many advertisers adapted through better ads, landing pages, or targeting to preserve ROI. Nonetheless, higher CPCs meant that smaller advertisers paid more for each click, and those that failed to optimise often generated fewer leads for the same level of spend.

Google Ads CPCs in 2025 were substantially higher than in 2024, with an overall increase of roughly 12–13% driven by widespread competition across industries. Some sectors experienced especially sharp cost increases, while a minority saw slight relief. The result was a more expensive advertising environment than the year before. In the next section, we explore why this surge occurred, examining factors ranging from Google’s algorithm and auction changes to broader market forces and what they meant for advertisers.

Why Are CPCs Rising? Key Factors Behind the 2025 Surge

Multiple data-driven factors contributed to the spike in Google Ads cost per click during 2025. It was not a single cause, but rather a confluence of changes across the advertising ecosystem and broader market conditions. Below are the major drivers identified by industry experts and benchmark reports.

-

Increased advertiser demand and competition: Simply put, more advertisers, often with higher budgets, competed on Google Ads throughout 2025, pushing bids upward. Digital ad spend continued to grow as businesses invested more heavily in online marketing in the post-pandemic environment. Many companies reallocated budgets into search advertising, sometimes due to challenges in other channels such as social media targeting limitations or data privacy changes.

When advertiser demand outpaced the growth in available ad inventory (search queries), CPCs rose. This dynamic was visible in spend-versus-click data, where ad spend increased by around 9% while click volume grew by only about 4%. More money chasing roughly the same number of clicks inevitably translated into higher costs per click.

Certain industries experienced especially strong competitive pressure. For example, Home Improvement services saw a notable rise in advertisers, likely tied to a robust housing and remodelling market, pushing CPCs in that category close to levels traditionally associated with legal services. In sectors such as Education, a shrinking pool of prospective students, often referred to as an “enrolment cliff”, made each lead more contested, driving bids higher despite lower overall demand. In short, advertisers were willing to pay more per click either because customer lifetime value justified it or because fewer opportunities were available, prompting more aggressive bidding.

-

Google’s auction algorithm and policy changes: Changes to how Google ran auctions and matched keywords during 2025 also played a significant role in rising CPCs.

-

Multiple ads per page policy: The update allowing a single advertiser to appear in multiple positions on the same results page intensified competition within auctions. Google’s own documentation acknowledged that this change could drive up costs. When a strong advertiser could secure both a top and bottom placement, they effectively captured additional impression share that might previously have gone to another advertiser at a lower bid. Competitors often responded by bidding more aggressively to secure any remaining positions.

While Google prevented advertisers from bidding against themselves, the overall competitive landscape per query became more skewed toward advertisers with the strongest quality signals and budgets. Industry commentators noted that this policy, which reversed long-standing restrictions on multiple ads per page, had the potential to further intensify competition and push CPCs higher across many sectors.

-

Separate auctions per slot: Google’s move toward separate auctions for each ad position (first, second, third, and so on) also influenced bidding behaviour. Winning the top slot became a distinct competition from simply appearing on the page. As a result, some advertisers bid more aggressively for position one, knowing it was a separate battle, which likely contributed to higher top-of-page CPCs.

-

Automation and Smart Bidding: Google’s continued push toward automated bidding strategies such as Target CPA and Maximise Conversions was another contributing factor. While automation improved conversion efficiency for many advertisers, it also led to higher CPCs, as the system was willing to bid aggressively for clicks deemed likely to convert.

According to LocaliQ, advertisers saw sharper CPC increases on campaigns using Smart Bidding, which was expected given Google’s direct control over those bids. As adoption of automated strategies increased throughout 2024 and 2025, this behaviour likely added upward pressure on CPCs platform-wide.

-

Keyword match type changes: During 2025, Google further blurred the lines between exact, phrase, and broad match types, heavily promoting broad matching supported by AI. Agency analysis highlighted a significant shift toward phrase and broad match, with a reduced share of exact match impressions.

Some advertisers observed a sharp drop in exact-match click share alongside a dramatic rise in exact-match CPCs between late 2024 and early 2025. As Google showed exact match ads less frequently, advertisers who insisted on precision competed in smaller auctions and often paid a premium. Meanwhile, broad match pulled advertisers into more competitive auctions unless carefully controlled with negatives. Overall, Google’s expanded matching and automation made it easier to spend across more queries but harder to maintain the same level of efficiency, contributing to higher average CPCs.

-

-

Inventory constraints (search volume and user behaviour): Unlike social platforms where inventory can expand endlessly, search advertising is constrained by how many users are searching and how many ad slots exist per results page. When search query volume remained flat or grew slowly while advertiser demand increased, CPCs rose.

In some categories, search volumes stagnated or declined, meaning advertisers competed more aggressively for fewer opportunities. At the same time, changes in user behaviour, such as higher click-through rates on ads, further increased CPCs. As Google highlighted, ad CTRs have risen consistently over the past several years, partly due to more prominent ad placements and ads blending more closely with organic results. While higher CTRs delivered more traffic, they also signalled that top ad positions were increasingly valuable, encouraging higher bids.

-

Macroeconomic pressures: Broader economic conditions also influenced CPC trends. Persistent inflation increased operating costs across many industries, and businesses responded by raising marketing spend to drive revenue growth. Even as inflation rates moderated, underlying costs did not return to pre-pandemic levels, including the cost of advertising.

Throughout 2025, inflation in many regions remained above historical norms, making higher bids more palatable as average sale values increased. At the same time, post-pandemic market adjustments continued to reshape demand. Travel and entertainment, for example, saw strong rebounds that brought more advertisers back into auctions, while other sectors faced softer demand, prompting advertisers to bid more aggressively for a smaller pool of conversions. Together, these macroeconomic factors formed a backdrop that supported higher CPCs.

In summary, the surge in CPCs during 2025 stemmed from a combination of forces: intensified advertiser competition, Google’s policy and auction changes, a relatively fixed supply of search inventory, and broader economic pressures. This “perfect storm” resulted in record-high CPC levels across many industries.

For advertisers, particularly small businesses, these higher costs reinforced the need for greater strategic discipline. The following section examines what these developments meant in practice for smaller advertisers and how they adapted to the changing Google Ads landscape.

Implications for Small Business Advertisers (and How to Adapt)

Small business owners and DIY advertisers typically operate with tighter budgets and are more sensitive to shifts in advertising conditions. The changes that played out during 2025 carried several important implications for this group.

-

Budget impact – fewer clicks for the same spend: With average CPC up by roughly 13%, small businesses generally received fewer clicks for the same budget than in the prior year. A click that previously cost $2.50 often cost closer to $2.80 by the end of 2025. Over a fixed monthly budget, this difference compounded quickly.

Industry data suggested that many small and mid-sized businesses needed budgets in the range of $1,000 to $2,500 per month to generate meaningful results. In local service industries where clicks commonly cost $3 to $7, a $1,000 monthly budget translated into only 200 to 300 clicks. As a result, businesses either had to increase spend or focus more tightly on high-value keywords, times, and locations to maintain lead volume.

-

Higher cost of leads – emphasis on ROI: As CPCs increased, cost per conversion became a critical metric. Unless conversion rates improved, each lead or sale became more expensive. One positive development during 2025 was that average conversion rates increased by around 6.8% year over year, helping to offset higher CPCs.

Small businesses that invested in landing page optimisation, clearer offers, and better tracking were often able to maintain acceptable cost per lead. Improving a conversion rate from 10% to 12.5%, for example, effectively neutralised a significant CPC increase. By the end of 2025, working smarter rather than simply spending more had become essential.

-

Impact of multiple ad placements on small players: Allowing large advertisers to appear twice on a single results page proved to be a double-edged sword. In markets dominated by national or global brands, smaller advertisers sometimes found it harder to secure first-page visibility, as dominant players occupied both top and bottom positions.

This increased the importance of monitoring Auction Insights and impression share metrics. In some cases, however, stricter enforcement against multiple ads in the same slot grouping reduced certain forms of abuse, such as affiliates double-serving ads. While outcomes varied by market, small businesses that closely tracked performance data were better positioned to respond.

-

Need for strong Quality Scores and relevance: As competition intensified, Google’s auction mechanics continued to reward relevance. Advertisers with higher Quality Scores paid lower effective CPCs. For small businesses, this made tight keyword selection, relevant ad copy, and aligned landing pages more important than ever.

Regular search term reviews and proactive use of negative keywords helped prevent wasted spend, particularly as broader matching expanded during 2025.

-

Strategic bidding and automation: Automated bidding delivered strong results for some advertisers, but it also contributed to higher CPCs in many accounts. Small businesses that monitored performance closely and adjusted targets or segmented campaigns by priority keywords tended to fare better than those that adopted automation blindly.

-

Leverage first-party data and niche targeting: First-party audiences, remarketing lists, and tight geographic targeting helped small businesses extract more value from each click. With CPCs higher, making every click count became a defining theme by the end of 2025.

-

Stay informed and adapt: Finally, the pace of change in Google Ads throughout 2025 reinforced the importance of staying informed. Policy updates, new campaign types, and evolving SERP layouts continued to reshape performance, making adaptability a key advantage for small advertisers.

Actionable Takeaways for Small Businesses:

-

Recalculate your ad budget: By the end of 2025, it became clear that many advertisers needed approximately 10–15% more budget to generate the same click volume they achieved in 2024. Planning ahead for seasonal campaigns with this baseline in mind proved essential.

-

Improve your conversion funnel: Investing time in A/B testing landing pages, improving website load speed, and refining offers remained one of the most effective defences against rising CPCs. Higher conversion rates helped offset higher click costs, as cost per lead is directly tied to CPC divided by conversion rate.

-

Monitor auctions and metrics: Throughout 2025, successful advertisers regularly reviewed Auction Insights to identify whether competitors were dominating impression share. Segmenting performance by “Top vs. Other” placements helped clarify where visibility was being lost. When impression share declined, improving Quality Score or adjusting bids often became necessary.

-

Optimise for Quality Score: Tight alignment between keywords, ad copy, and landing pages continued to pay dividends. For DIY advertisers, tools such as Google’s Keyword Planner and recommendations helped surface relevant terms, but selectivity mattered. Keywords with persistently low Quality Scores (for example, 3/10) often undermined overall efficiency and were best paused or reworked.

-

Use match types and negatives wisely: Relying blindly on broad match across all keywords proved costly in 2025. Advertisers who combined phrase and exact match for core terms, alongside robust negative keyword lists, maintained better control. This approach reduced spend on irrelevant queries introduced by AI-driven matching, which was especially important as each click became more expensive.

-

Evaluate bidding strategies: Whether using manual or automated bidding, regular review was critical. Testing automation on a limited basis allowed advertisers to assess whether CPA actually improved. Conversely, campaigns where Target CPA or similar strategies began bidding disproportionately high amounts for individual clicks required recalibration to ensure the economics still made sense.

-

Focus on your strengths: Competing on broad, nationwide keywords against large brands was rarely sustainable for small businesses. Those that concentrated on long-tail, local, or niche keywords typically faced lower CPCs and less competition, delivering stronger ROI by year end.

-

Keep communication clear with clients (for agencies): For agencies managing small business accounts, setting expectations became increasingly important in 2025. Explaining that CPC inflation was an industry-wide reality rather than a result of mismanagement, and outlining concrete mitigation strategies, helped maintain trust as costs rose.

By applying these approaches, small businesses and budget-conscious advertisers were better positioned to navigate the Google Ads landscape in 2025. While market-wide costs remained outside individual control, advertisers could control how they responded: which queries they bid on, how effectively their ads converted, and how efficiently budgets were allocated. As one LocaliQ expert observed, “A smart strategy beats cheap clicks.” Paying more per click became unavoidable for many, but disciplined execution ensured that each click delivered greater value.

Conclusion

The Google Ads ecosystem in 2025 presented both challenges and opportunities for advertisers. The platform’s move to allow multiple ads from the same domain on a single results page marked a meaningful shift in ad-serving policy, intended to improve user experience and advertiser value, while raising legitimate questions about competitive balance. At the same time, the cost of advertising on Google Search rose sharply, with average CPC reaching new highs across most industries. This increase reflected a combination of intensified competition, auction and algorithm changes, and broader economic pressures.

For businesses, particularly small and medium-sized advertisers, these developments reinforced the need for a data-driven and adaptable approach. Budgets and strategies often had to be reassessed, with greater emphasis placed on optimisation to extract more value from each click. The environment was undeniably more competitive by the end of 2025, but advertisers who invested in smarter tactics, from improving Quality Scores to refining targeting and leveraging conversion data, were still able to perform well. In many cases, higher CPCs accelerated positive change, rewarding those who ran better campaigns rather than simply larger ones.

Ultimately, Google Ads remained a powerful channel for driving leads and sales throughout 2025. While the year’s updates raised the stakes, they also coincided with improvements such as stronger conversion rates and new ad formats that skilled advertisers could harness. Small business owners and Google Ads DIYers could view the lessons of 2025 as a prompt to elevate their marketing discipline. By understanding the trends and applying the actionable insights outlined above, advertisers entered the next year better prepared to succeed despite higher costs and an evolving search landscape.